Featured

Table of Contents

Don't hesitate to ask questions and clear up assumptions prior to accepting a position. As soon as you've found the ideal remote treatment work, it's time to prepare your online technique for success. Producing a professional, effective, and client-centered teletherapy setting assists give high-quality care and construct solid restorative connections. Here are the crucial aspects to consider: Obtain a dependable, high-speed internet connection (at the very least 10 Mbps), a computer or laptop computer that fulfills your telehealth system's demands, and a top notch cam and microphone for clear video clip and sound.

Use noise-reducing techniques and preserve privacy by stopping interruptions during sessions. Usage energetic listening, keep eye contact by looking at the cam, and pay focus to your tone and body language.

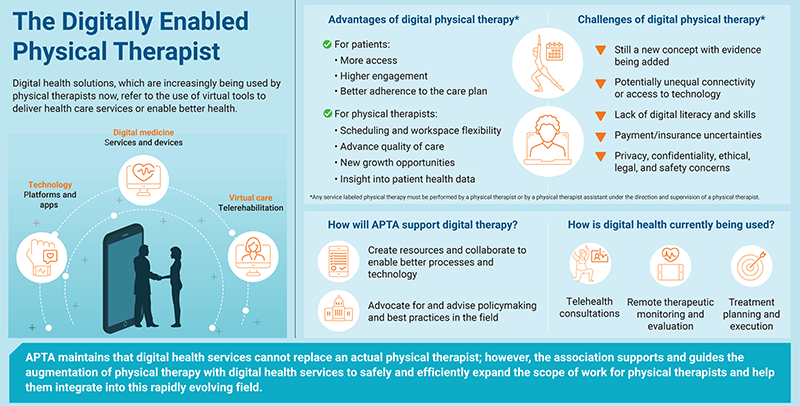

Working remotely gets rid of the demand for a physical workplace, reducing expenses associated with rent, utilities, and maintenance. You also save money and time on commuting, which can minimize tension and improve overall well-being. Remote therapy raises accessibility to take care of customers in backwoods, with limited flexibility, or dealing with other barriers to in-person treatment.

Creating Your Location-Independent Therapy Business

Working remotely can occasionally really feel isolating, lacking face-to-face interactions with associates and clients. Managing customer emergency situations or dilemmas from a range can be hard. Telehealth requires clear methods, emergency contacts, and knowledge with neighborhood sources to make certain client safety and security and suitable treatment.

Remaining informed about transforming telehealth guidelines and best methods is very important. Each state has its very own laws and laws for teletherapy technique, consisting of licensing needs, notified authorization, and insurance coverage reimbursement. Staying on par with state-specific standards and acquiring needed authorizations is a continuous duty. To flourish long-lasting as a remote therapist, concentrate on growing professionally and adjusting to the transforming telehealth setting.

The Security Imperative

A crossbreed model can supply versatility, reduce screen fatigue, and permit for an extra progressive shift to totally remote job. Try different mixes of online and face-to-face sessions to locate the appropriate equilibrium for you and your customers. As you navigate your remote treatment profession, keep in mind to prioritize self-care, established healthy and balanced boundaries, and seek support when needed.

Research study regularly shows that remote treatment is as effective as in-person therapy for common mental health conditions. As even more customers experience the convenience and comfort of receiving treatment at home, the approval and demand for remote solutions will certainly continue to expand. Remote specialists can earn competitive salaries, with capacity for higher revenues with field of expertise, private method, and job advancement.

The Freedom Formula

We comprehend that it's helpful to chat with a real human when questioning website design business, so we would certainly like to arrange a time to talk to ensure we're a good mesh. Please fill up out your details below to make sure that a member of our group can aid you obtain this procedure started.

Tax obligation reductions can save self-employed specialists cash. If you do not recognize what qualifies as a compose off, you'll miss out on out., the Internal revenue service will demand invoices for your tax reductions.

There's a whole lot of discussion amongst organization proprietors (and their accountants) regarding what constitutes a service dish. Given that meals were commonly abided in with enjoyment costs, this produced a great deal of anxiety amongst company proprietors who generally subtracted it.

Normally, this means a dining establishment with either takeout or sit down solution. Components for dish preparation, or food acquired for anything besides immediate intake, do not certify. To qualify, a dish must be purchased during a service trip or shown an organization associate. Much more on business travel reductions listed below.

What Research Says: Research Support

Learn more about subtracting service meals. resource If you take a trip for businessfor instance, to a meeting, or in order to lecture or help with a workshopyou can deduct a lot of the prices. And you may also have the ability to squeeze in some vacationing while you're at it. So, what's the difference in between a vacation and a company trip? In order to certify as service: Your trip should take you outside your tax home.

You should be away for longer than one work day. A lot of your time should be invested operating. If you are away for four days, and you spend three of those days at a conference, and the 4th day taking in the sights, it counts as an organization journey. Reverse thatspend three days taking in the sights, and one day at a conferenceand it's not a company journey.

You need to be able to show the trip was planned ahead of time. The internal revenue service wishes to avoid having company owner tack on expert activities to entertainment journeys in order to transform them into overhead at the last moment. Preparing a composed schedule and itinerary, and scheduling transportation and accommodations well ahead of time, assists to show the journey was primarily business related.

When utilizing the gas mileage price, you do not consist of any kind of various other expensessuch as oil adjustments or routine upkeep and repair services. The only additional automobile expenses you can subtract are parking charges and tolls. If this is your very first year possessing your vehicle, you need to determine your deduction making use of the mileage rate.

Geographic SEO

Some additional education prices you can subtract: Guidance costsBooks, journals, and trade publications connected to your fieldLearning supplies (stationery, note-taking applications, and so on)Learn more about deducting education and learning expenses. source If you exercise in a workplace outside your home, the expense of rent is completely deductible. The expense of energies (heat, water, electricity, internet, phone) is additionally insurance deductible.

Latest Posts

Recovering Your Weekends with AI

Getting This Right: Standards

Main Topic Cluster: Online Therapy Services